Hilton Daily Food and Beverage Credit Information 2024

Some food for thought.

Some food for thought.

This is yet again another extension...

This is not the first time this has happened. Nor will it be the last.

Will this change streamline the boarding process?

NoMad Hotels brand is to be expanded worldwide by Hilton.

Which airports are receiving funds — and how much are they receiving?

A total of 29 countries now comprise the Schengen area of Europe.

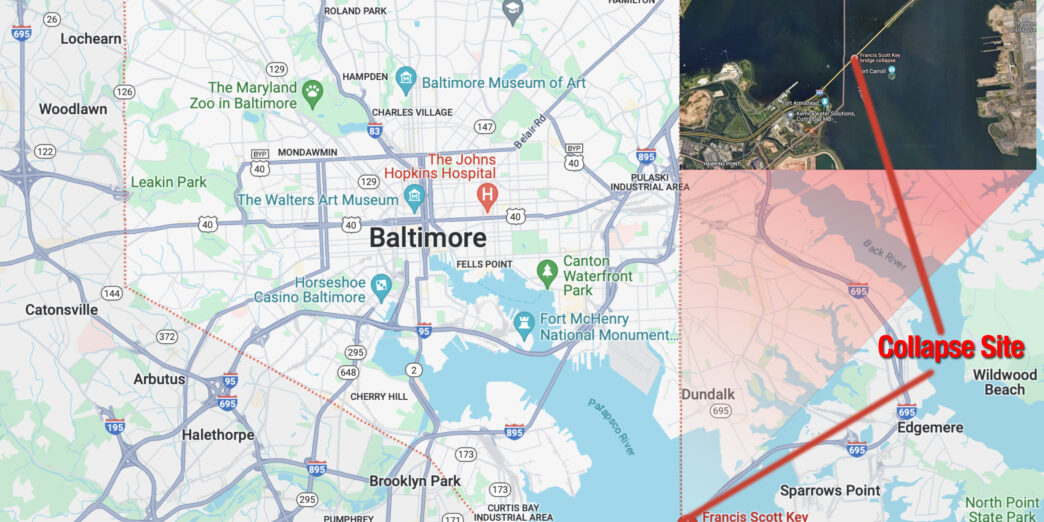

A container ship crashed into one of the supports of this key bridge.

A sweepstakes has been announced as part of the launch.

These hotel properties will soon Graduate with Honors.

Join our mailing list to receive the latest news and updates from our team.