Cash can be cumbersome — especially when large quantities of it are needed — and protecting it from getting lost or stolen is paramount, as once cash is lost or stolen, it is usually gone with no hope of getting it returned. Credit cards are far more convenient, as the holder is usually only responsible for $50.00 in unauthorized charges should a nefarious individual steal it or use it; and accounting is much simpler — plus one may be able to earn rewards and enjoy benefits which are not afforded by cash…

Which Countries and States Want — Or Reject — A Cashless Society?

…but which countries and states in the United States want a cashless society — and which countries and states in the United States reject a cashless society?

To find out the answers to those questions and to gauge the sentiment of each country and state in the United States towards cashless payments, geotagged messages from Twitter were retrieved containing the following search terms: Cashless, Contactless, Google Pay, Apple Pay, Samsung Pay, Microsoft Wallet, PayPal, Alipay, Facebook Pay, Walmart Pay, Mozido, Dashlane, Veno, Zelle, Paycloud.

Any duplicates were removed, allowing only a maximum of one message from Twitter per account per day. Only messages from Twitter written in English, Spanish, German, French or Italian were assessed.

An artificial intelligence algorithm using Hugging Face application programming interface Wass then applied to classify messages from Twitter as having a positive, negative, or neutral sentiment, which allowed places to be classified as “wanting” or “rejecting” a cashless society based on whether the percentage of positive or negative — or want or reject, respectively — cashless messages from Twitter was higher.

Finally, all regions were ranked by both the percentage of positive messages from Twitter and percentage of negative messages from Twitter to create maps that show which states and countries have the strongest sentiment toward wanting or rejecting a cashless society.

The results for the countries were further filtered by adding a minimum threshold of 100 messages from Twitter, leaving us with 88 countries.

The data was collected in September 2022.

This article from Merchant Machine highlights which countries and states in the United States want a cashless society — as well as which countries and states in the United States reject a cashless society; and I have been given express written permission to use the graphs and the verbatim text from the aforementioned article in this article. While Merchant Machine has endeavored to ensure the information provided is accurate and current, it cannot guarantee it, as this information is general in nature only and does not constitute personal advice. Neither Resume.ioMerchant Machine nor The Gate accept any liability — and assume no responsibility — for any and all information which is presented in this article.

With that disclaimer out of the way, here is the article.

Countries and States In The United States Which Want — Or Reject — A Cashless Society

If you’re one of the 43% of people in America who don’t carry cash with them, you’re likely to reach for your card or phone to make the payment. In fact, more and more people in the U.S. and around the world aren’t paying with cash at all when they go shopping.

Some countries, like Japan, are making big changes to ride the cashless wave, while in others, cash remains king. Presuming that someone has access to both and can choose between them, there are lots of factors that can influence someone’s preferred method of payment.

For example, you might like that cash is readily available from ATMs, and physically accounting for it can help you budget better. But banking apps and digital wallets enable you to organize your income and outgoings at the touch of a button, and to make quick and efficient transactions.

Both sides of the argument have strong points, and everyone has their own individual preference — but like it or not, non-cash transactions are on the increase worldwide, indicating a move towards a cashless future. So, where do countries and U.S. states stand on the issue today? We turned to Twitter to find out whether people are more for or against a cashless society.

What We Did

For each country and U.S. state, Merchant Machine calculated the proportion of negative and positive tweets about going cashless using an AI sentiment analysis tool. A country was determined to want a cashless society if they counted a larger proportion of positive tweets than negative.

Key Findings

- The majority (54) of countries want to go cashless

- Only two U.S. states (Alabama and Delaware) don’t want a cashless society

- Vietnam is the most pro-cashless country in the world

- France, Italy and the UK are among the most anti-cashless countries

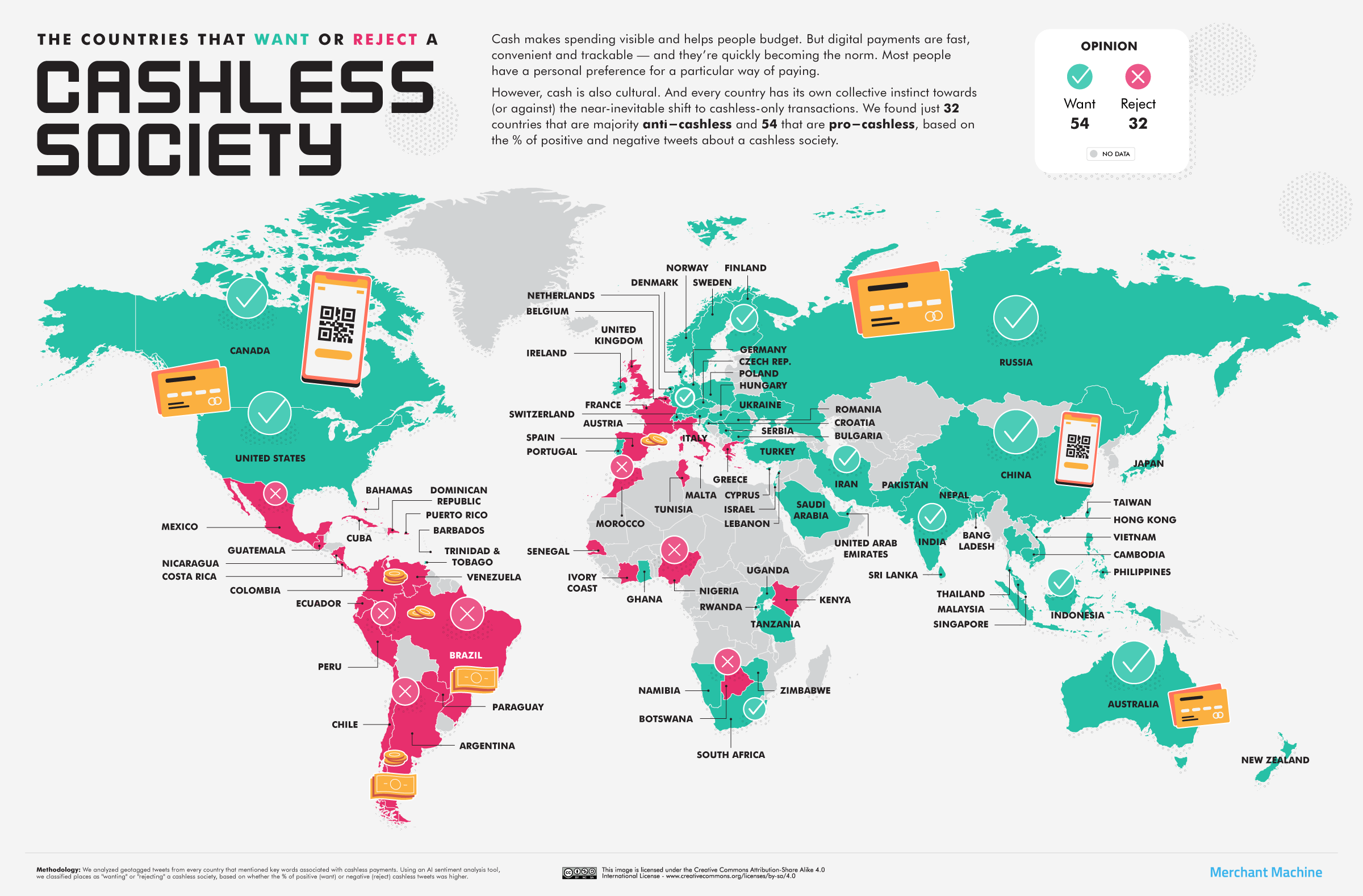

The Majority of Countries Want to Go Cashless

Overall, we found that the majority (54) of countries want a cashless society, while the 32 countries remaining in our analysis reject the idea. Among the countries that are done with cash are the U.S., Canada, Russia and Australia. All but four of those pro-cashless countries (Cyprus, Switzerland, Austria and Germany) post positive tweets at least 25% of the time.

Some of the ‘want’ countries on our map are leading the world when it comes to developing a cashless society. Of them all, Sweden is by far the closest to achieving a totally cashless society. According to the European Payments Council, only 1% of the country’s GDP is represented by cash, and cash withdrawals have been declining 10% annually.

Instead of cash, many people in Sweden use Swish, an app created by six major Swedish banks back in 2012. Cashlessness is important culturally, too: as the official Swedish website proclaims: “Cashless payments very much go hand in hand with the Swedish lifestyle.”

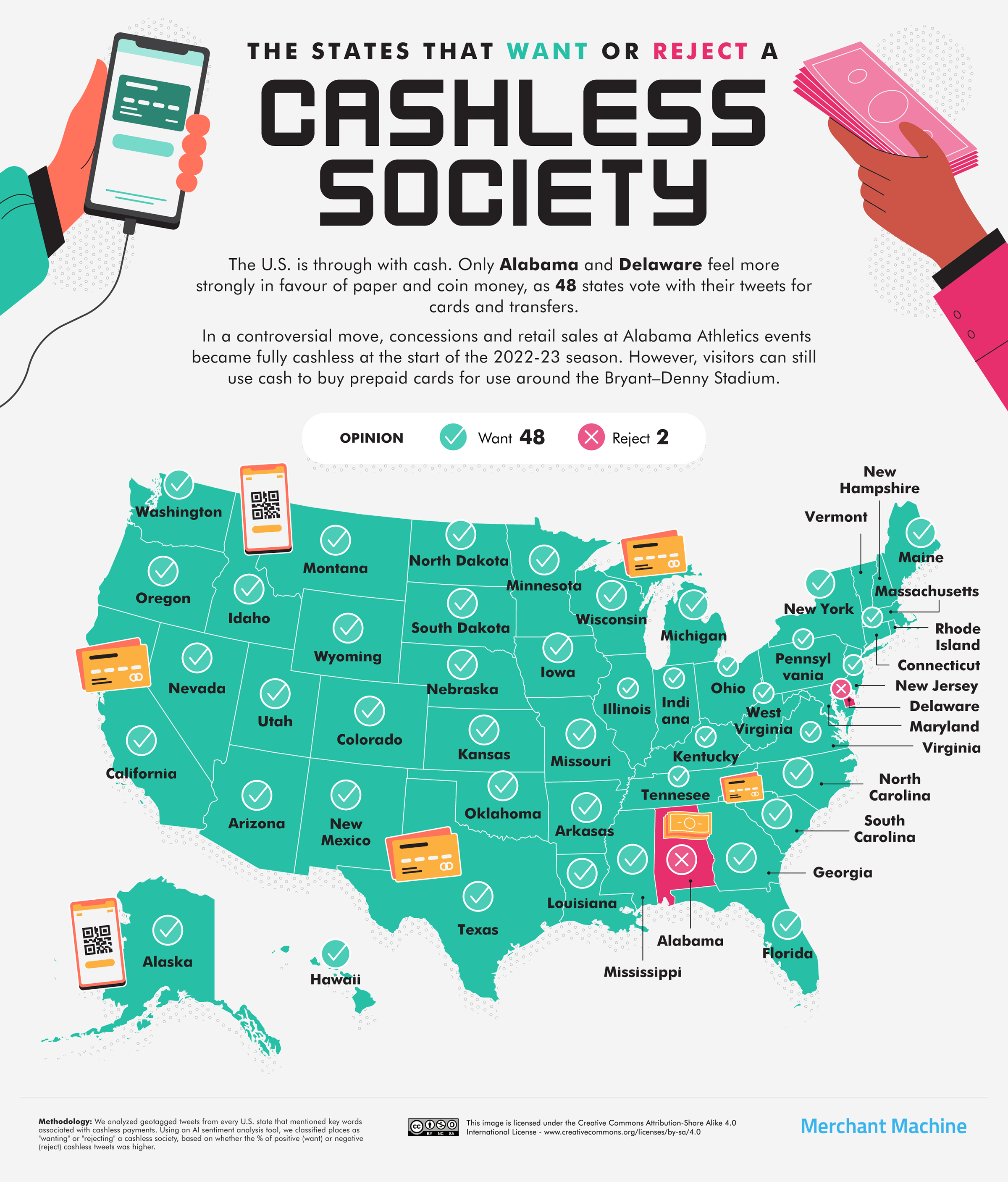

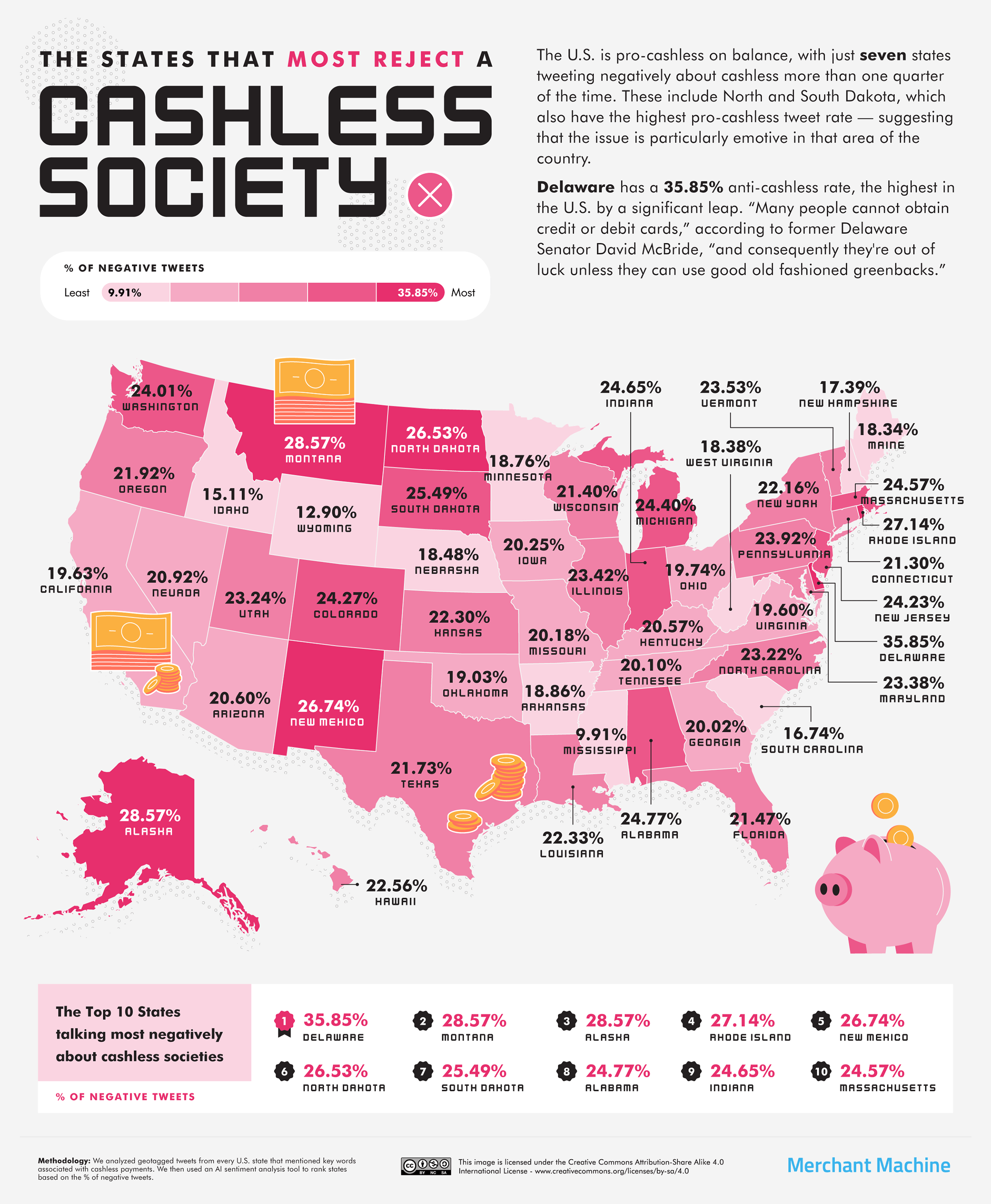

Every U.S. State but Alabama and Delaware Wants a Cashless Society

Our data reveals that every state but two (Alabama and Delaware) wants to go cashless. It makes sense that the majority of Americans are okay with parting ways with cash: fewer people in the U.S. are using it at the checkout than five years ago, and four in ten (43%) people don’t carry it at all. Even President Biden is exploring the possibility of a digital dollar.

The COVID-19 pandemic is considered to be a watershed period in America’s embrace of cashless methods. One YouGov poll found that over a third (36%) of people in the U.S. who preferred to use cash to make payments found themselves making cashless payments more during the pandemic.

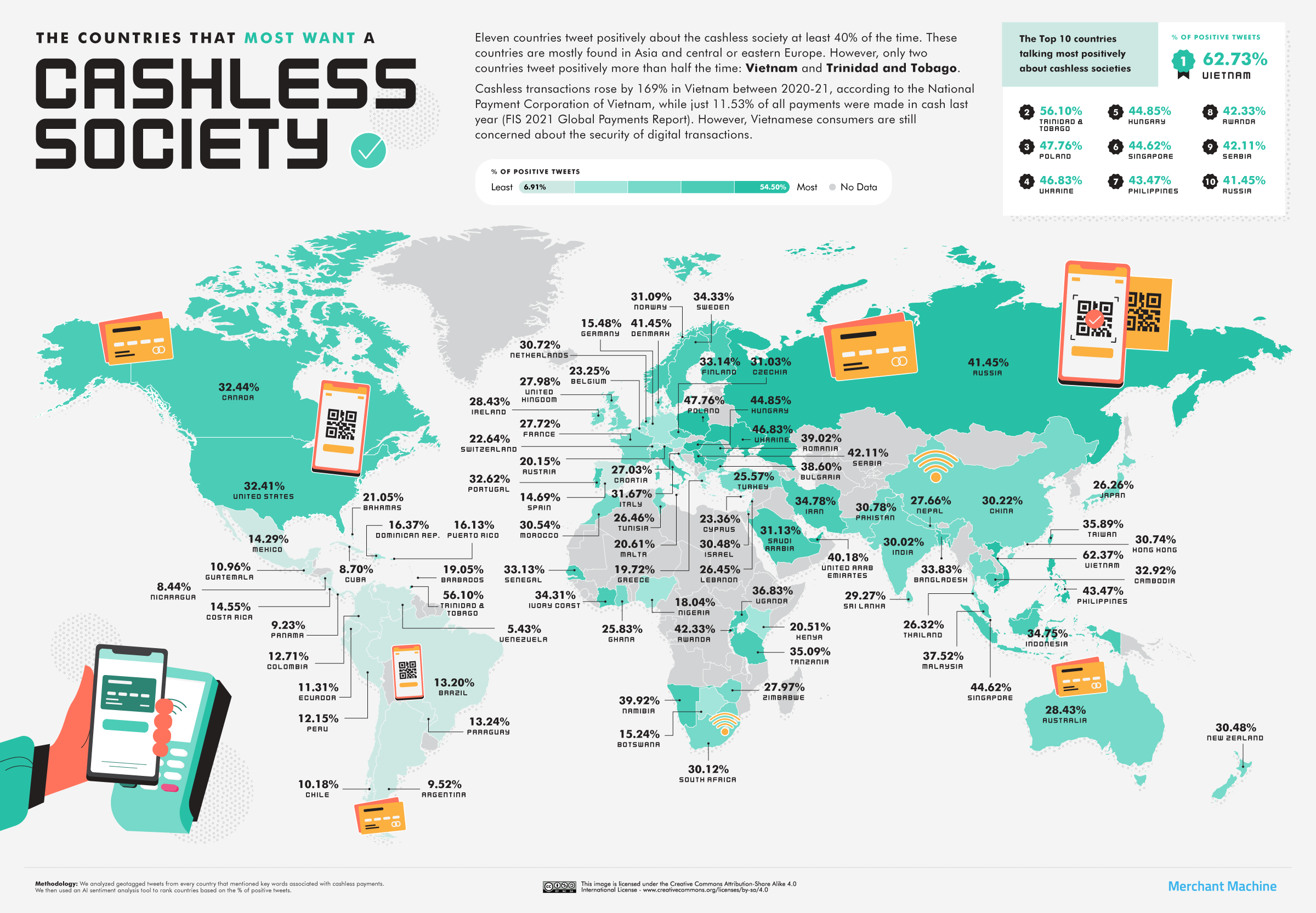

Vietnam Is the Most Pro-Cashless Country in the World

Of all the tweets made in Vietnam that mention cashless payment methods, nearly two in three (62.73%) are positive. That makes Vietnam the most pro-cashless country in the world. Not only does Vietnam have a fairly high rate of non-cash transactions (an increase of 76% from 2021), but a new government project plans to encourage a cashless society in the next few years. Between 2021 and 2025, the project’s four main objectives include making non-cash payments a standard in urban and rural areas and developing a safe cashless infrastructure.

Other pro-cashless countries, according to our data, include Trinidad and Tobago (56.10%), Poland (47.76%) and Ukraine (46.83%). Though cash is still important in Trinidad and Tobago, plans to make the country a cashless society are in the works. In 2020, the FinTech Association of Trinidad and Tobago was launched to “facilitate a globally competitive ecosystem that will establish Trinidad & Tobago as a leading FinTech-enabled society.”

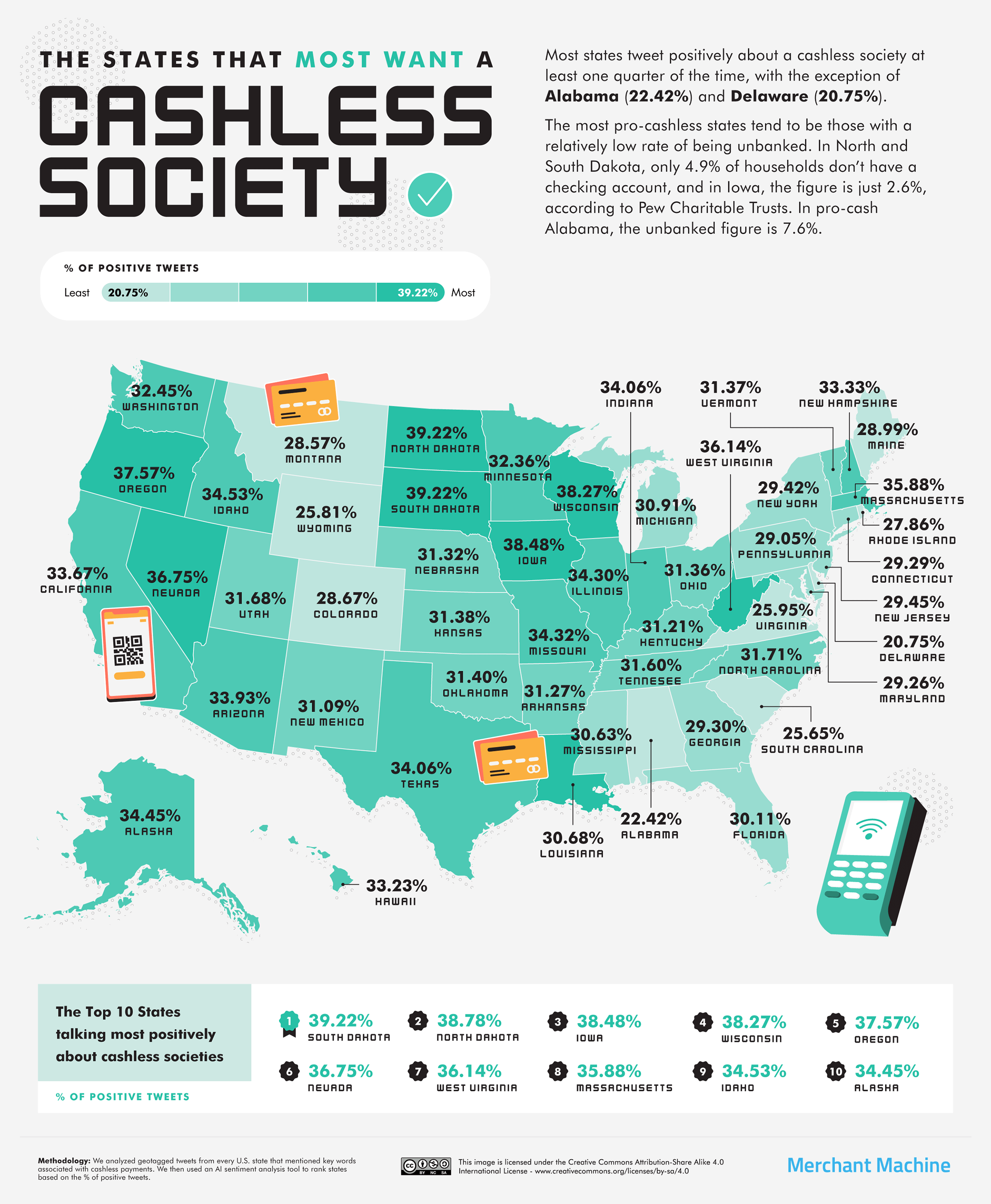

Most U.S. States Are Positive About a Cashless Society

Our data reveals the percentage of positive tweets posted about cashless societies in every state in the U.S. The most positivestates are South Dakota (where 39.22% of tweets are positive), North Dakota (38.78%), Iowa (38.48%) and Wisconsin (38.27%). Most states in the country tweet positively about going cashless at least 25% of the time.

Local moves to transition away from cash in South Dakota include Wind Cave National Park’s switch to cashless payments. In North Dakota, a proposed bill to ban cashless stores — a move already made elsewhere in the country — was rejected.

But why are Americans so in favour of saying goodbye to cash? According to one study, a third (33%) of Americans feel that not having cash would make travelling easier, while others think that cashless payments are more efficient and better for budgeting.

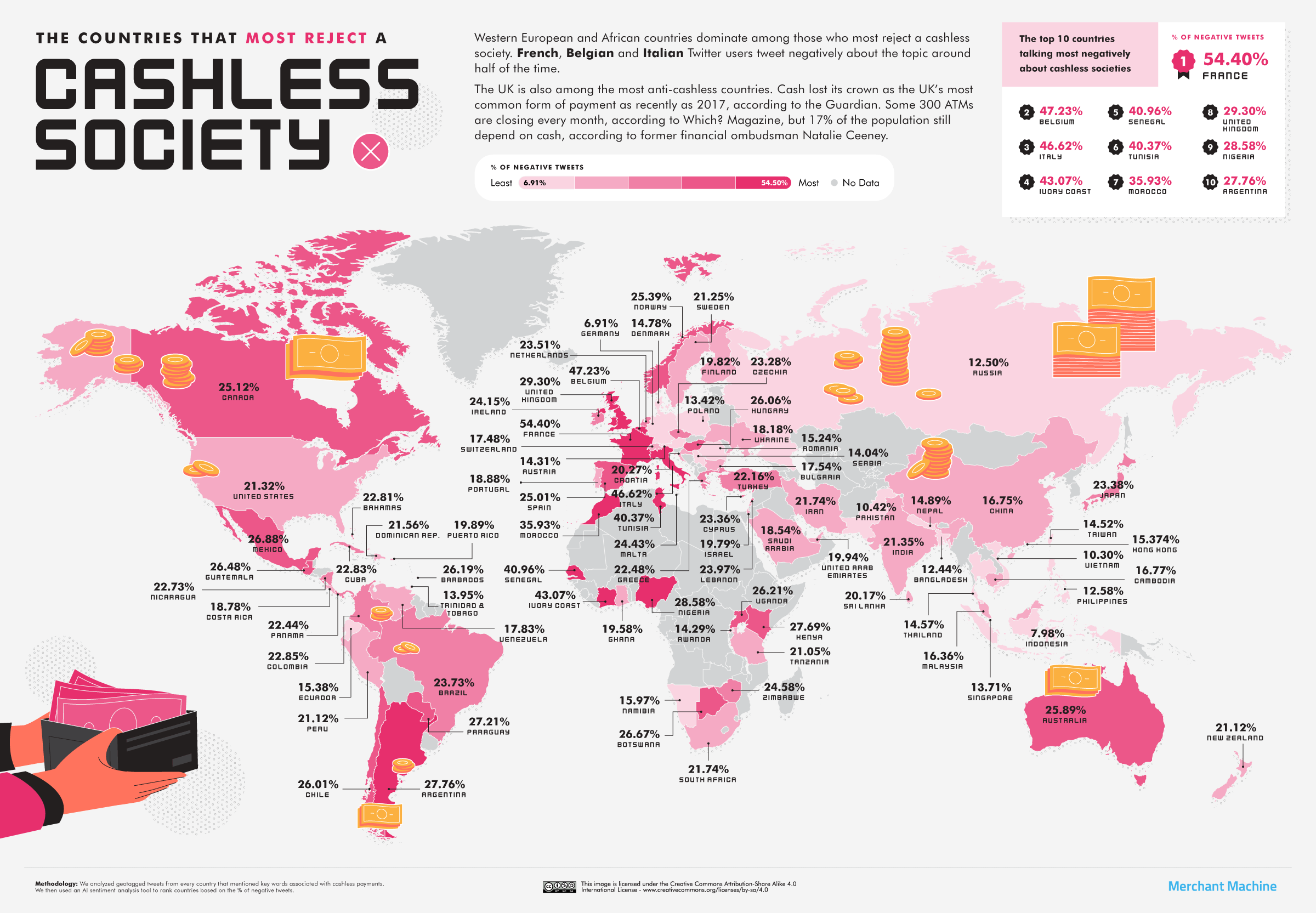

France Is the Most Anti-Cashless Country in the World

France is the most anti-cashless country in the world: over half (54.40%) of the tweets posted there about going cashless are negative. According to a 2019 study, cash is the dominant payment method in France, making up 59% of transactions, and nearly half (44%) of people in France think it is “important” or “very important” to have the option to pay for things in cash. More and more people in France are also choosing to withdraw cash from their bank accounts and keep it at home.

Other anti-cashless countries in our analysis include Belgium (where 47.23% of tweets are negative), Italy (46.62%) and the Ivory Coast (43.07%). Despite more than 23 million people in the country barely using cash in 2021, the UK (29.30%) is also fairly anti-cashless, according to our analysis. One YouGov poll revealed that nearly two-thirds of people in the UK think that using cashless methods increases the chance of falling victim to fraud or theft, and a petition that sought to protect cash as a payment option reached over 200,000 signatures.

Anti-Cashless U.S. States Are in the Minority

While the majority of states tweet positively about going cashless, not everybody on Twitter is as happy about the subject. The most anti-cashless states based on the proportion of negative tweets include Delaware (35.85%), Montana (28.57%), Alaska (28.57%) and Rhode Island (27.14%).

In the U.S., there’s been backlash against moves to make stores totally cashless. In fact, Delaware happens to be one of the several cities and states in the U.S. where cashless stores are banned, along with the likes of San Francisco and New Jersey. Public criticism has also seen store chains like Sweetgreen reverse their decision to go totally cashless.

There are some very valid reasons to keep cash flowing. One of the demographics that would be impacted by going completely cashless is America’s “unbanked,” i.e., the 6.5% of U.S. households without any sort of bank account.

How Would You Like to Pay?

With so many neobanks, digital wallets and apps making it easier than ever to pay for things without cash, it’s clear that a cashless future is a reality for many, and it’s one that lots of people look forward to. That being said, our research shows just how divisive the subject is.

While there are many benefits to going cashless, one of the key problems of a cashless world is that it would affect people without access to a bank account or the technology to use it. When it comes to how quickly we’ll reach a totally cashless future, it’s likely it won’t be anytime soon; as Henk Esselink of the European Central Bank comments, “In 2030, a considerable share of payments will still be in cash, at least in terms of the number of payments.”

For a full breakdown of how positively or negatively each U.S. state and country tweets about going cashless, explore our table below.

Final Boarding Call

The board of governors of the Federal Reserve System of the United States — which is the central bank for the country — is considering the creation of a digital version of the United States dollar as what is known as a central bank digital currency. Should the united states dollar become digital currency?

I prefer to use credit cards instead of cash — especially when I can earn bonuses and take advantage of benefits which are offered by the credit card that cash simply cannot provide.

Do you prefer a cashless society — or do you reject it?

Photograph ©2022 by Brian Cohen.